Peloton has had one of the most turbulent decades in technology. The home gym industry has had consecutive highs and lows. It’s a story of incredible beginnings that has become the target of a cult following among influencers and fitness enthusiasts. The global pandemic shot the brand to unknown heights, before massive investments, recalls, multiple bankruptcies and management departures caused the brand to collapse in the world.

As of mid-2024, the Peloton is down, but not out. The company avoided a major credit default by refinancing major debt in late May. That marked the end of a month that also saw a 15% staff cut and the exit of CEO Barry McCarthy more than two years after he replaced founder John Foley.

Peloton’s high-profile roller-coaster ride has had far-reaching consequences. Excitement grew at the rate of the epidemic, but as soon as the world began to reopen, sales collapsed. Some who were addicted to something that is widespread in society have remained loyal to the brand. However, many others lost that connection. Uncertainty can be avoided with any exercise, but undoubtedly those figures were exacerbated by the opening of gyms and other forms of exercise.

The result is that many unused pieces of expensive exercise equipment are sitting in homes across America; now it’s “clothing areas,” as a co-worker recently said about his Peloton bike. A quick search on Facebook Market reveals row after row of stationary bikes, regularly listed around $300 to $500 – a fraction of the cost of a new model (around $1,500). For many once-enthusiastic owners, hardware has become a nuisance. But for two East Coast entrepreneurs, it’s an opportunity.

Trade My Spin’s origin story begins in humble beginnings, when CEO Ari Kimmelfeld began looking for a good deal on a used Peleton bike. As good as the prices on Facebook and Craigslist were, when it came to buying new from the manufacturer, the experience had its issues.

“There was a lot of disruption, a lot of buying,” Kimmelfeld, who at the time worked at Ernst & Young’s science division, EY-Parthenon, tells TechCrunch. “Five hundred dollars was a lot of money, and to meet a stranger and give them money to buy stuff you can’t inspect. Also, I live in New York City. It’s hard to find something like that from an apartment in Brooklyn to Manhattan. Also, there is no warranty. ”

Local resources

Kimmelfeld launched what would become Trade My Spin last year, picking up and selling used Peloton merchandise. At its heart, the offering was a DIY equipment game, taking the hassle out of buying and selling used exercise equipment. It was a conversation with Joey Benjamini that turned a one-man operation into a viable business.

Benjamini built a contract-based inventory network for Collectible Classics. His Pennsylvania-based used car business relies on contract drivers to transport vehicles for sale through the used car platform, Bring a Trailer.

“Hardware is the most complex and the most important part of this business — and the biggest barrier to entry,” Benjamini tells TechCrunch. “We have a collection of 1099 contracts that bring us goods. We are constantly growing that network of drivers who know our company and our operations. Once the driver is trained, we send them out to ride the bikes. It’s very easy.”

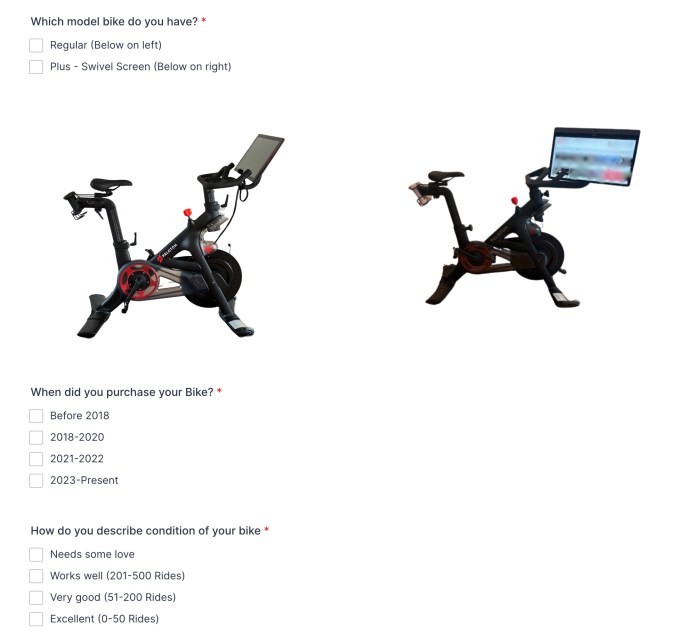

The new team started working on the Trade My Spin site before looking for money. The page remains simple, as the list continues to grow to include Peloton treadmills, rowers and other accessories. The Buy button displays a busy marketplace for services, while the Sell button displays a form for the apps you want to download. While the site was in place, the small company produced a small seed before the scale of the operation.

Talking to Peloton

The startup has also had many conversations with Peloton since it officially launched in March. The main purpose of Trade My Spin on mobile is to convince that their relationship is a symbiotic – not a parasitic – relationship. At first glance, it’s easy to understand why Peloton would be against the company.

Considered a zero-sum game, every used bike sold represents a potential sale lost to a new bike. While it’s true that keeping bikes around is the right net for the operation, there’s no doubt that Peloton’s shareholders are looking at a key selling point in hopes of seeing a change.

The numbers change, however, when you consider that Peloton’s primary goal is to be a content company that sells apps, not the other way around. Instead of using bike trades as conversions, Trade My Spin’s rate is that each bike removed from circulation is one less subscription to Peloton’s content platform.

Benjamini says: “Every bike we take is from someone who doesn’t use that bike. If one does not use the bike, one does not use the subscription. Peloton is a subscription service. It’s $44 a month. Every time we flip a bike — and we flip thousands of bikes — they make $500 a year.”

There is no doubt that the relationship would be different if Peloton was more proactive about managing its used equipment. Eventually, however, Trade My Spin stepped in to fill that gap in the market.

A new product

Trade My Spin has assembled a network of dealers capable of same or next day delivery in most major cities in the continental US. take to work instructions.

In the short term, the expansion includes adding more practice tools to Trade My Spin’s options buying and selling. In the long term, the company wants to strengthen its growing network of contractors to include the purchase and sale of all types of non-functional items. Trade My Spin may require additional spins to get there.

“We want to change,” Benjamini says. That’s the game plan, and no one else will. There is a barrier to getting in and out of the business in terms of having drivers. “

#Trade #Spin #builds #business #Peloton #tools #TechCrunch