This is The Takeaway from today’s Morning Brief, which you can Register to receive in your inbox every morning along with:

“It can be fixed, but it will take time,” a Starbucks ( SBUX ) insider with knowledge of the company’s many problems recently told me.

The sentiment has left a lasting impression, especially after Starbucks’ earnings results last week.

Starbucks features popped briefly after a quarter that can only be described as madness:

-

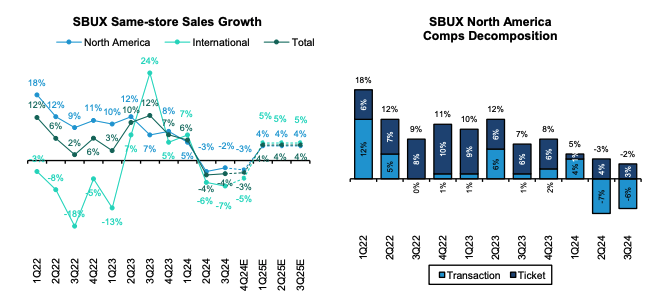

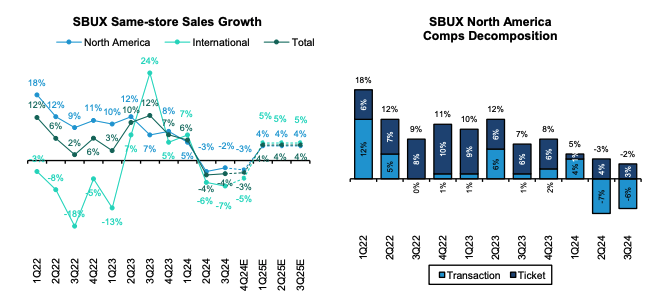

6% of sales are down in North America.

-

International comparable sales were up 7%.

-

Comparable retail sales in China fell 14%.

-

Non-GAAP operating profit margins fell to 16.7% from 17.4% last year.

The market’s reaction was surprising, and it was probably due to the fact that management was cheating a few greenbacks in the business with the earnings call (although, to be fair, sales of cold espresso are it was up 4%…) – or what they did. perceive like green shoots.

The Street — burned by Starbucks for much of the past two years (the stock is down 9% versus a 35% gain for the S&P 500 during that time) — largely didn’t buy.

“Macro, boycotts, resistance to prices, or working in the shop is the cause of the decline in North America? We have not found a unique answer to this question, suggesting that all reasons (or none (anything?) Although Starbucks points out that there are temporary problems, we believe that other structural (but not invincible) spirits also play a role (eg, store saturation, increased competition, appeal which is disappearing from younger and occasional customers and declining in-store experiences),” Bernstein restaurant analyst Danilo Gargiulo said in a consumer note.

The bigger picture: The company’s one-time specialty and growth stock is up 21% over the past five years, according to Yahoo Finance data.

And this black eye of the size of the soul is not blue. Consider what we’ve seen at Starbucks over the past 12 months.

Howard Schultz — the billionaire meddling founder turned failed candidate — didn’t rip off his handpicked successor Laxman Narasimhan in a LinkedIn post, but undermined his authority.

Talk about a kick in the butt for a new CEO who trained in stores for months with Schultz before officially taking over. Narasimhan is also a successful C-suite executive with a successful track record.

But it’s also a reminder of how Schultz can’t seem to let go of fame and a determined desire to stalk the company like a hungry old lion.

Narasimhan was then publicly shamed on live television in a professional interview by my friend and former manager Jim Cramer.

I encourage everyone to watch how Jim conducted this discussion; that’s how investors should evaluate a company’s fundamentals and leadership. Hats off to Jim for holding “Lax”‘s feet to the fire and demanding loyalty.

Restaurant managers I’ve spoken to privately since this interview still can’t believe how mean and unprepared Narasimhan was – several said he might not be around until 2025. a stumbling block to society.

So there’s all of that, from being embarrassed on TV and the internet to outrageous amounts of money.

Then there’s a nasty fight between Starbucks and the feared investor Elliott Management.

A source familiar with the situation tells me that Elliott – who has accumulated a large stake in Starbucks – settled the issue with the company three weeks ago. Elliott is looking for more people to be added to the 10-member board (Microsoft Vice President Satya Nadella resigned in May), as well as corporate governance reforms.

Starbucks has not yet responded to Elliott’s proposal, the source said.

A spokesman for Elliott declined to comment to Yahoo Finance on the situation.

Narasimhan told analysts on the earnings call this week that the discussions had been “constructive.”

Bottom line: Starbucks looks like a shell of its former self now.

And much of this can be traced back to 71-year-old Howard Schultz and the fundamental problems at Starbucks that I posted on X a few weeks ago (see below), which cannot be easily fixed.

Schultz needs to get out of Starbucks right away so the management team can be free to make mistakes and grow, the board can evaluate management outside of the founder’s perspective, and new talent can rise to the top of the corporation.

There is no longer an outgoing chairman position. Board meetings and parking at HQ will no longer be allowed, as the FT reports. There are no more olive oil sales, as the FT also reports. There are no more things like this in the company’s proxy files:

“Starbucks and Mr. Schultz’s entities previously entered into a management services agreement and leased hangar space for Mr. Schultz’s aircraft. Pursuant to the management services agreement, the entity that owns Mr. Schultz uses his aircraft to use services provided by Starbucks and pays Starbucks fees for such services, the amount of which is set at market rates, Mr. Schultz’s organization pays Starbucks rent based on its share of maintenance, equipment and more. expenses paid by Starbucks for the hangar.”

And Schultz – with an estimated income of 3.1 billion dollars, according to Forbes – pays for his security services instead of Starbucks (according to the reports of the representative of the company).

Rest in peace and thanks for your service, Howard. We wish you the best, thank you for changing the coffee place and restaurant forever.

Elliott’s move to Starbucks isn’t surprising, it’s surprising that it took this long.

10 Things Wrong with Starbucks

1. The leadership style of believing that the company does everything perfectly.

2. Rushes product innovation.

3. Crazy complicated menu.

4. Poor quality food.

5. HQ hugs…

– Brian Sozzi (@BrianSozzi) July 19, 2024

Then, to fix this hot mess, Starbucks needs to be restructured in culture and mindset.

Its C-suite needs to know that the world doesn’t revolve around its Seattle headquarters. There are plenty of places that sell better and faster coffee (see Yahoo Finance’s Brooke DiPalma’s amazing profile of Dutch Bros’ upcoming competitor).

It needs to realize that unions are not going to put Starbucks out of business and it is the workers who are trying to live a better life. Internet sentiment among the new generation of consumers is not as favorable as it used to be.

And they have to admit that Starbucks is a mature organization, and fixing a lot of problems won’t happen overnight – so stop giving cream and syrup to these pay lines. Give it to investors directly; numbers and stock prices don’t lie.

Until then, this first flying cargo may be as cold as a freshly poured nitrous can.

Starbucks declined to make CEO Laxman Narasimhan available for an interview.

Three times each week, I give insightful interviews with the biggest names in business and markets in my opinion. Opening Bid podcast. Get more features from us video center. Look at yours popular streaming service. Or listen and subscribe to Apple Podcasts, Spotifyor wherever you find your favorite podcasts.

In Opening Bid below, investor and retail expert Jeff Macke delves into the many challenges retailers are currently facing.

Brian Sozzi is the Editor-in-Chief of Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and further LinkedIn. Tips on deals, mergers, activist positions, or anything else? Email brian.sozzi@yahoofinance.com.

Click here for all the latest stock news and events to better inform your investment strategy

#Starbucks #shell #glory #Morning