The AR Advanced Technology, Inc. (TSE:5578) share price has performed very poorly in the past month, down 26%. The decline over the past 30 days has capped a tough year for shareholders, with the share price down 46% in that time.

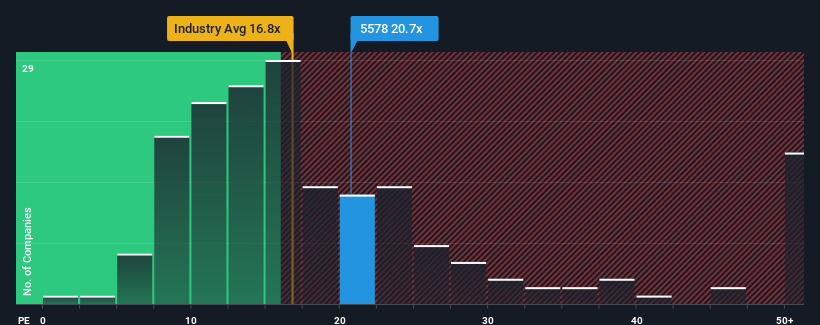

Even though its price has dropped significantly, the advanced AR technology’s price-to-earnings ratio (or “P/E”) of 20.7xe still makes it look like a strong bargain right now compared to the Japanese market, where almost half of the companies have P/E ratios below 13x and even P/Es below 9x are common. However, we will need to dig a little deeper to determine if there is a logical basis for such a high P/E.

For example, the declining revenues of advanced AR technology in recent days will have to be considered. It is likely that many expect the company to outperform many other companies in the future, which has kept the P/E from collapsing. If not, shareholders may be very nervous about the performance of the share price.

Check out our latest review for advanced AR technology

Looking for a complete picture of earnings, revenue and cash flow for a company? Then ours for free A report on the advanced AR technology will help you shed light on its historical performance.

Is There Enough Growth For Advanced AR Technology?

In order to justify its P/E ratio, advanced AR technology will need to generate better growth than the market.

If we check the last year of earnings, disappointingly the profit of the company dropped to 26%. Even the last three years don’t look good as the company has reduced EPS by 33% overall. So unfortunately, we have to accept that the company hasn’t done a good job of growing earnings in that time.

Comparing that to the market, which is expected to deliver 9.9% growth over the next 12 months, the company’s decline based on recent mid-term earnings results is a serious picture.

With this information, we find that advanced AR technology is trading at a higher P/E than the market. Apparently many investors in the company are stronger than recent times would indicate and are not willing to give up their property at any price. Only the brave can assume that these prices are sustainable as recent earnings developments may weigh heavily on the share price in the long run.

The Last Word

Advanced technology AR’s shares may be down, but its P/E is still flying high. Generally, we would caution against reading too much into price-to-earnings ratios when making investment decisions, even though it can reveal a lot about what other market participants think about a company.

Our analysis of advanced AR technology has shown that its medium-term declining earnings are not affecting its high P/E as much as we would have predicted, while the market is set to grow. We are currently uncomfortable with a high P/E as this earnings performance is unlikely to sustain such a view in the long term. Unless conditions improve significantly in the medium term, it is very difficult to accept these prices as reasonable.

There are also some important risk factors to consider before investing and we have found them 3 warning signs for advanced AR technology what you should be aware of.

If you you are not sure about the commercial potential of advanced AR technologywhy not check out our list of stocks with solid business fundamentals for some companies you may have missed.

New: Manage all your stock portfolios in one place

We made the ultimate portfolio partner for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Alerting of new Warning Signs or Hazards by email or phone

• Track the Quality of your goods

Try Demo Portfolio for free

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not include recent company announcements that are not sensitive to pricing or quality equipment. Simply Wall St has no position in the stocks mentioned.

Have a comment about this article? Are you concerned about the news? Contact us directly. Alternatively, email editorial-team@simplywallst.com

#Risks #Raised #Prices #advanced #technology #TSE5578 #Shares #Dive