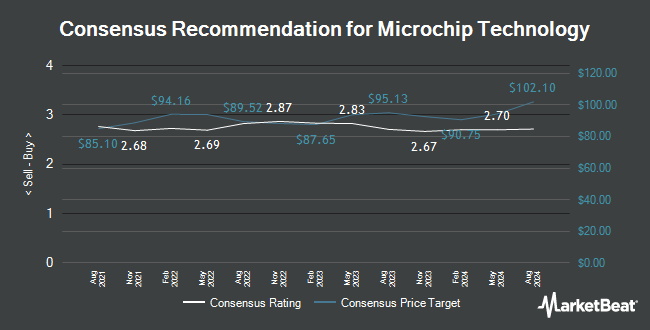

Microchip Technology (NASDAQ:MCHP – Get Free Report) had its price target cut by stock analysts at TD Cowen from $90.00 to $80.00 in a report released on Friday, MarketBeat.com reports. The firm currently has a “hold” rating on the semiconductor company’s stock. TD Cowen’s price target would indicate a potential upside of 6.06% from the stock’s current price.

Microchip Technology (NASDAQ:MCHP – Get Free Report) had its price target cut by stock analysts at TD Cowen from $90.00 to $80.00 in a report released on Friday, MarketBeat.com reports. The firm currently has a “hold” rating on the semiconductor company’s stock. TD Cowen’s price target would indicate a potential upside of 6.06% from the stock’s current price.

A number of financial analysts have also issued reports on the company. Mizuho raised Microchip Technology from a “neutral” rating to a “buy” rating and upped their target price for the company from $85.00 to $115.00 in a report on Friday, May 24th. B. Riley lifted their price target on Microchip Technology from $105.00 to $110.00 and gave the company a “buy” rating in a report on Tuesday, May 7th. Citigroup upped their price objective on Microchip Technology from $100.00 to $104.00 and gave the company a “buy” rating in a research report on Tuesday, May 7th. KeyCorp lifted their price objective on Microchip Technology from $90.00 to $110.00 and gave the company an “overweight” rating in a research note on Tuesday, May 7th. Finally, UBS Group lifted their price objective on Microchip Technology from $95.00 to $103.00 and gave the company a “buy” rating in a research note on Tuesday, May 7th. Seven equities research analysts have rated the stock with a hold rating and fourteen have assigned a buy rating to the company’s stock. According to MarketBeat data, Microchip Technology currently has an average rating of “Moderate Buy” and an average price target of $99.15.

See our latest Report on MCHP

Microchip Technology Stock Performance

Shares of MCHP opened at $75.43 on Friday. The firm has a market capitalization of $40.47 billion, a P/E ratio of 21.74 and a beta of 1.54. The company has a debt-to-equity ratio of 0.75, a quick ratio of 0.67 and a current ratio of 1.20. The stock has a 50-day moving average of $91.66 and a 200-day moving average of $89.42. Microchip Technology has a 52-week low of $68.75 and a 52-week high of $100.57.

Microchip Technology (NASDAQ:MCHP – Get the Free Report ) last released its earnings results on Thursday, August 1st. The semiconductor company reported $0.53 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.52 by $0.01. The company had revenue of $1.24 billion during the quarter, compared to analyst estimates of $1.24 billion. Microchip Technology had a return on equity of 27.82% and net income of 20.80%. Microchip Technology’s revenue for the quarter was down 45.8% on a year-over-year basis. At the same time last year, the company posted earnings of $1.56 per share. Equities analysts predict that Microchip Technology will post 2.35 earnings per share for the current fiscal year.

Buying and Selling Inside

In related news, Director Matthew W. Chapman sold 2,748 shares of the stock in a transaction on Monday, June 10th. The stock was traded at an average price of $93.88, for a total of $257,982.24. Following the sale, the director now owns 35,682 shares of the company’s stock, valued at $3,349,826.16. The sale was disclosed in a document filed with the Securities & Exchange Commission, available at this link. In related news, VP Stephen V. Drehobl sold 7,830 shares of the stock in a transaction on Thursday, May 16th. The stock was traded at an average price of $95.06, for a total of $744,319.80. Following the transaction, the vice president now owns 79,509 shares of the company’s stock, valued at $7,558,125.54. The transaction was disclosed in a legal filing with the SEC, which can be found via this hyperlink. Also, Director Matthew W. Chapman sold 2,748 shares of the stock in a transaction on Monday, June 10th. The shares were traded at an average price of $93.88, for a total of $257,982.24. Following the completion of the transaction, the director now directly owns 35,682 shares in the company, valued at approximately $3,349,826.16. Information on this sale can be found here. In the last quarter, insiders have sold 23,993 shares of company stock worth $2,251,857. Corporate insiders own 2.07% of the company’s stock.

Institutional Benefits and Benefits

Institutional investors have recently added or reduced their stakes in the company. Rakuten Securities Inc. purchased a new position in Microchip Technology in the fourth quarter valued at $27,000. Rise Advisors LLC bought a new position in shares of Microchip Technology during the first quarter valued at about $28,000. Pineridge Advisors LLC purchased a new position in shares of Microchip Technology during the fourth quarter valued at about $33,000. Steph & Co. grew its stake in shares of Microchip Technology by 57.4% during the first quarter. Steph & Co now owns 414 shares of the semiconductor company’s stock valued at $37,000 after buying an additional 151 shares in the last quarter. Finally, Pathway Financial Advisers LLC bought a new position in shares of Microchip Technology during the first quarter valued at approximately $39,000. Institutional investors own 91.51% of the company’s stock.

Microchip Technology Company Profile

(Get a Free Report)

Microchip Technology Incorporated develops, manufactures and markets intelligent, connected and secure embedded control solutions in the Americas, Europe and Asia. The company offers general purpose 8-bit, 16-bit, and 32-bit microcontrollers; 32-bit embedded microprocessors; and specialized microcontrollers for automotive, industrial, computer, communications, lighting, power supply, vehicle control, human-machine interface, security, telecommunication, and wireless communication applications .

See Also

Get Microchip Technology News and Reviews Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ data for Microchip Technology and related companies with MarketBeat ‘s FREE daily newsletter .com.

#Microchip #Technology #NASDAQMCHP #Reduced