List of shares of MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI) shareholders may be feeling a little disappointed, as its shares fell 3.0% to US $97.13 on the week following its latest third quarter results. Looks like a pretty good result, all things considered. Although revenues of US$190m were in line with analysts’ estimates, official earnings were very weak, missing estimates by 21% to US$0.27 in total. Earnings are an important time for investors, as they can track a company’s performance, look at what analysts are predicting for the coming year, and see if there has been a change in sentiment about the company. With this in mind, we’ve rounded up the latest legal predictions to see what analysts are expecting for next year.

Check out our latest analysis for MACOM Technology Solutions Holdings

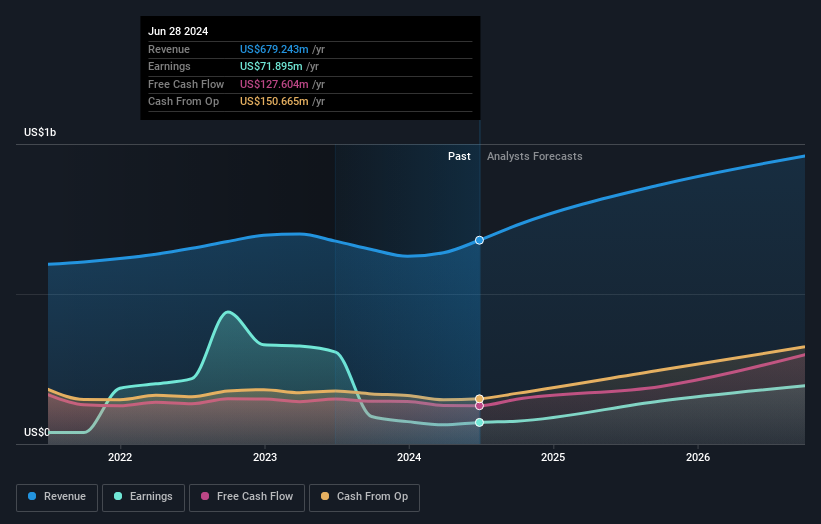

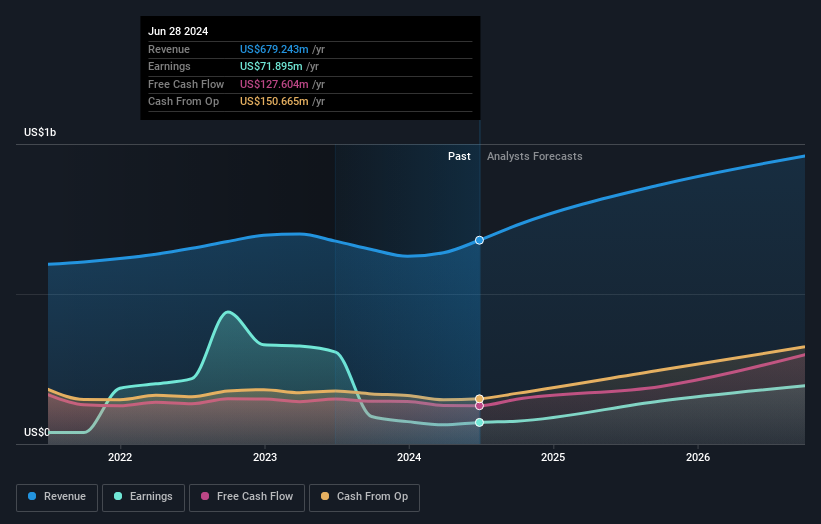

Taking into account the latest results, the latest consensus for MACOM Technology Solutions Holdings from 14 analysts is a revenue of US$ 864.3m in 2025. If combined, it will mean a significant increase of 27% of its revenue in the last 12 months. Statutory earnings per share are estimated to jump 95% to US$1.95. Prior to this report, analysts were modeling revenue of US$852.4m and earnings per share (EPS) of US$1.98 in 2025. Consensus analysts do not seem to see anything in these results that would have changed . their views on the business, as there was no significant change in their estimates.

It is not surprising then, to know that the target price of the agreement does not change much at US $ 118. However, there is another way to think about the price targets, and that is to look at the types many of the price targets set by analysts, because different estimates can give different opinions about the possible results for the business. Currently, the largest analyst values MACOM Technology Solutions Holdings at US$135 per share, while the lowest estimate is US$85.00. Analysts certainly have different opinions about the business, but the spread of estimates is not enough in our opinion to suggest that extreme results can represent the shareholders of MACOM Technology Solutions Holdings.

Of course, another way to look at these estimates is to rank them against the industry itself. It is clear from the latest estimates that the growth rate of MACOM Technology Solutions Holdings is expected to accelerate significantly, with an annual revenue growth forecast of 21% until the end of 2025 faster than the growth of a historic 7.0% over the past five years. Compare this to other companies in the same industry, which are predicted to grow their revenue by 18% annually. MACOM Technology Solutions Holdings is expected to grow at the same rate as its industry, so it is not clear that we can draw any conclusions from its growth to competitors.

The Bottom Line

The obvious conclusion is that there has not been a major change in business expectations in recent times, while analysts have held their earnings estimates steady, based on previous estimates. They also confirmed their revenue estimates, with the company predicting that it will grow at the same rate as the broader industry. There was no real change in the consensus price target, suggesting that the value of the business has not undergone significant changes in recent estimates.

With that in mind, we can’t rush to a conclusion about MACOM Technology Solutions Holdings. Long-term earnings power is more important than next year’s earnings. We have a forecast for MACOM Technology Solutions Holdings coming out in 2026, and you can see it for free on our platform here.

That said, it is still necessary to consider the investment risk that is always present. We have identified one warning sign and MACOM Technology Solutions Holdings, and understanding this should be part of your investment process.

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not include recent company announcements that are not sensitive to pricing or quality equipment. Simply Wall St has no position in the stocks mentioned.

Have a comment about this article? Are you concerned about the news? Contact us directly. Alternatively, email editorial-team@simplywallst.com

#MACOM #Technology #Solutions #Holdings #Missed #EPS #Heres #Analysts #Happen