-

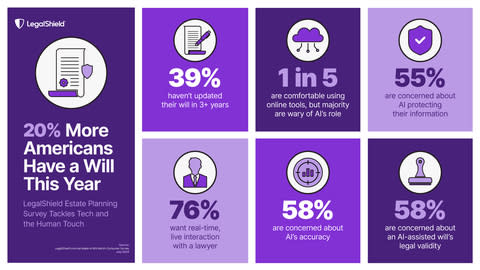

76% want a real-time, live chat with an attorney for estate planning

-

Many do not trust AI’s ability to create a valid, protected and valid will

-

Digital assets were often neglected, putting the heirs at risk

ADA, OK., August 06, 2024–(BUSINESS WIRE)– Against the background of news developments in AI and its potential use in the legal field, a study conducted by LegalShield revealed doubts about the use of new software solutions for development of the will. While an increasing number of Americans are involved in estate planning, more than three-quarters of respondents revealed a strong tendency to consult with an attorney.

“Everyone’s situation and circumstances are unique, especially when it comes to making personal life plans,” said Warren Schlichting, CEO of LegalShield. “If there’s ever a time to listen and empathize, it’s during the difficult process of estate planning and choosing beneficiaries in your will – no software can do that.”

More Desires and Alternatives: Digital Distrust Opens Up

According to a July survey, almost 20% of people have a will this year than last year, and although some respondents expressed comfort in using online tools for improvement of the will, three out of four respondents (76%) cited their choice. speak with a legal professional for wills and estate planning, either in person or over the phone.

The survey also revealed that Americans are wary of relying on technology like AI to write a will; More than half of respondents cited multiple concerns about using AI, including its ability to create an accurate document (58%), protect their information (55%), and create an accurate document legal (58%).

That’s not to say there isn’t a place for AI in the legal realm.

“AI is an enabler, not a solution, and I don’t see that changing,” said Ashley Higginbotham, managing attorney at Deming Parker LLC, a LegalShield client firm. “While we use a variety of digital tools to collect and organize information from our customers, our strengths are listening to the intentions of our customers and using our legal expertise to ensure that their will or their trust protects them and their loved ones.”

“Listening is not transference — it’s not just about pushing the right buttons or making the right suggestions — it’s about context and meaning. Communication is the best way to ensure a true understanding of a person’s concerns our customers, and making sure they keep their legacy, not the government,” Higginbotham said.

Outdated and Neglected: The Internet Legacy Challenge

The study also found that most Americans have neglected their digital assets in estate planning, with 58% of respondents not considering what will happen to their digital assets after death. .

Higginbotham said: “Digital assets are becoming an important part of many places, and people are collecting more every year. “Online records of a loved one are often not found after death, so working ahead of time to plan, contacting financial institutions to establish beneficiaries, and writing clear directives are an important part of the estate planning process.”

Through its network of law firms, LegalShield handles tens of thousands of estate planning calls every month, including trusts, wills, and powers of attorney, and offers a variety of options, including online resources, telephone interviews and in-person meetings. However, creating a property plan is only the first step. More than a third (39%) of Americans have not updated their will in three years or more and given how quickly Americans’ lives – and possessions – are going digital, the schedule Regular updates are important.

“It’s not clear which is worse, not having a will, or not developing your will,” Schlichting said. “It’s not about wealth or how tech-savvy you are; it’s about taking and maintaining control over life’s uncertain circumstances and providing a clear road map for your loved ones.”

Method: LegalShield surveyed 1,252 US adults, age 18 and older, in July 2024. The sample was balanced by age, among other demographics, to in the US Census.

About LegalShield:

For more than 50 years, LegalShield has provided everyday Americans with easy access to legal advice, counsel, protection and representation. Serving millions of people, LegalShield is one of the world’s largest brands of legal services, information and reputation management that protects people and businesses across North America. Founded in 1972, LegalShield, and its privacy management product, IDShield, has provided individuals, families, businesses and employers with the tools and services they need to live a fair and secure life. Through technology and innovation, LegalShield is disrupting the traditional legal system and changing the way people find legal guidance and services, with access to thousands of qualified, trusted lawyers and law firms. LegalShield and IDShield are products of Pre-Paid Legal Services, Inc. To learn more about LegalShield and IDShield, visit LegalShield.com and IDShield.com.

Check out the source version at businesswire.com: https://www.businesswire.com/news/home/20240806620515/en/

Names

LegalShield Media Contact:

Hollon Kohtz, Communications Director

hollonkohtz@pplsi.com

#Hype #LegalShield #Study #Finds #Americans #Remain #Aware #Technologys #Role #Real #Estate #Planning