B. Riley Wealth Advisors Inc. boosted its stake in Aspen Technology, Inc. (NASDAQ: AZPN – Free Report) by 89.4% in the first quarter, according to the company in a filing with the Securities & Exchange Commission. The institutional investor owned 2,114 shares of the technology company’s stock after buying an additional 998 shares during the quarter. Property of B. Riley Wealth Advisors Inc. in Aspen Technology was worth $432,000 at the end of the most recent quarter.

B. Riley Wealth Advisors Inc. boosted its stake in Aspen Technology, Inc. (NASDAQ: AZPN – Free Report) by 89.4% in the first quarter, according to the company in a filing with the Securities & Exchange Commission. The institutional investor owned 2,114 shares of the technology company’s stock after buying an additional 998 shares during the quarter. Property of B. Riley Wealth Advisors Inc. in Aspen Technology was worth $432,000 at the end of the most recent quarter.

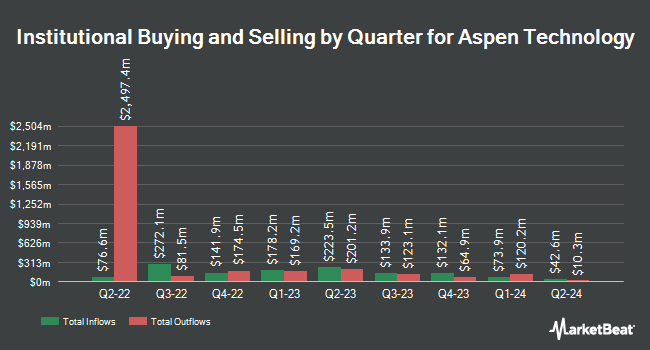

Several other institutional investors have also recently modified their holdings of AZPN. Benjamin F. Edwards & Company Inc. lifted its holdings in shares of Aspen Technology by 561.8% during the first quarter. Benjamin F. Edwards & Company Inc. now owns 225 shares of the technology company’s stock worth $48,000 after acquiring an additional 191 shares in the last quarter. Robeco Institutional Asset Management BV raised its stake in shares of Aspen Technology by 2.4% during the fourth quarter. Robeco Institutional Asset Management BV now owns 31,634 shares of the technology company’s stock worth $70,000 after buying an additional 735 shares in the last quarter. Principal Securities Inc. acquired a new stake in shares of Aspen Technology during the 4th quarter valued at about $73,000. UniSuper Management Pty Ltd increased its stake in shares of Aspen Technology by 100.0% in the first quarter. UniSuper Management Pty Ltd now owns 400 shares of the technology company’s stock valued at $85,000 after buying an additional 200 shares in the last quarter. Finally, Covestor Ltd increased its holdings in Aspen Technology by 36.0% in the first quarter. Covestor Ltd now owns 468 shares of the technology company’s stock worth $100,000 after buying an additional 124 shares in the last quarter. Institutional investors and hedge funds own 45.66% of the company’s stock.

Wall Street Analysts Forecast Growth

Several analysts have commented on AZPN shares. Berenberg Bank raised shares of Aspen Technology from a “hold” rating to a “buy” rating and boosted their price target for the stock from $185.00 to $255.00 in a research report on Friday, May 17th. Piper Sandler reduced their price objective on shares of Aspen Technology from $196.00 to $180.00 and set a “neutral” rating for the company in a report on Wednesday, May 8th. William Blair raised Aspen Technology to “hold” rating in a research report on Tuesday, May 7th. Finally, Robert W. Baird restated an “outperform” rating and set a $230.00 price objective on shares of Aspen Technology in a report on Friday, June 14th. Three research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. According to MarketBeat, the stock has an average rating of “Moderate Buy” and a price target of $219.50.

Check out our latest Review on AZPN

Aspen Technology Stock Performance

NASDAQ AZPN opened at $181.93 on Friday. The stock has a 50-day moving average of $197.75 and a 200-day moving average of $199.61. Aspen Technology, Inc. it has a twelve month low of $162.26 and a twelve month high of $224.06. The stock has a market capitalization of 11.52 billion, a PE ratio of -413.47, a P/E/G of 2.26 and a beta of 0.73.

Aspen Technology (NASDAQ:AZPN – Get the Free Report ) last posted its quarterly earnings results on Tuesday, May 7th. The technology company reported $1.54 EPS for the quarter, topping analysts’ consensus estimates of $1.15 by $0.39. The company had revenue of $278.11 million during the quarter, compared to analyst estimates of $251.65 million. Aspen Technology had a positive return on equity of 2.76% and a negative margin of 2.46%. As a group, equities research analysts predict that Aspen Technology, Inc. will post 5.52 EPS for the current fiscal year.

Aspen Technology Company Profile

(Free Report)

Aspen Technology, Inc provides industrial software focused on helping customers in the world’s most resource-intensive industries. The company’s solutions deal with complex situations where it is important to improve equipment design, performance and maintenance life. Its software is used in process engineering, modeling and design, supply chain management, predictive maintenance, digital grid control, and industrial data management.

Featured articles

Want to see how other hedge funds are holding AZPN? Visit HoldingsChannel.com for the latest 13F filings and insider trading for Aspen Technology, Inc. (NASDAQ:AZPN – Free Report).

Get Aspen Technology Daily News and Reviews – Enter your email address below to receive a concise daily summary of the latest news and analysts’ data for Aspen Technology and related companies with MarketBeat ‘s FREE daily newsletter .com.

#Aspen #Technology #NASDAQAZPN #Stock #Rating #Raised #Riley #Wealth #Advisors