RichWave Technology Corporation (TWSE:4968) shareholders will not be happy to see that the share price has had a very bad month, down 27% and reversing the good performance of the past period. Indeed, recent declines have reduced its annual profit to a relatively flat 8.6% over the past twelve months.

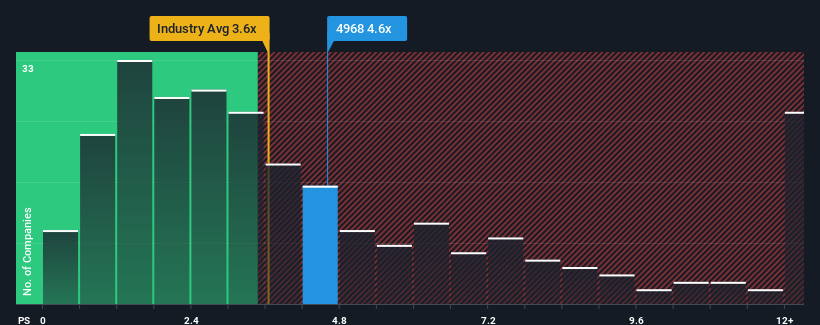

Although its price has fallen significantly, with nearly half of the companies in Taiwan’s semiconductor industry having price-to-sales (or “P/S”) ratios below 3.6x, you may considers RichWave Technology a stock that is probably not worth researching. Its 4.6x P/S ratio. However, the P/S may be high for a reason and needs further research to determine if it is correct.

Check out our latest review of RichWave Technology

How has RichWave technology worked recently?

With revenue growth higher than other companies of late, RichWave Technology is doing very well. It appears that many expect the strong earnings performance to continue, which has pushed up the P/S. However, if this is not the case, investors may be caught paying too much for the stock.

Want a complete picture of analyst estimates for a company? Then ours for free A report on RichWave Technology will help you uncover what’s next.

What Do Revenue Growth Metrics Tell Us About a High P/S?

The only time you can really be comfortable seeing a P/S as high as RichWave Technology’s is when the company’s growth is on pace to outpace the industry.

Looking back, we see that the company managed to grow revenue by 14% effective last year. However, in the end, it was not able to change the poor performance of the past, and the tax has decreased by 49% in total in the last three years. Therefore, it is fair to say that recent revenue growth has been unfavorable for the company.

Looking ahead now, revenue is expected to rise 31% next year according to the five analysts that follow the company. That makes it higher than the 26% growth rate for the broader industry.

With this information, we can see why RichWave Technology trades at such a high P/S relative to the industry. Apparently the shareholders don’t want to let go of something that might have a more prosperous future.

The Key Takeaway

There’s still upside to RichWave Technology’s P/S, even if the same can’t be said for its price lately. Arguably the price-to-sales ratio is an undervalued measure within certain industries, but it can be a powerful indicator of business sentiment.

Our look at RichWave Technology shows that its P/S ratio remains high in light of its strong future earnings. At this point investors feel that the possibility of a decline in earnings is too remote, justifying a high P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Do not forget that there may be other risks. For example, we saw One warning sign for RichWave Technology what you should be aware of.

Of course, profitable companies with a history of strong earnings growth are usually safe bets. So you might want to see this for free a collection of other companies with reasonable P/E ratios and strong earnings growth.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High Growth Tech and AI Companies

Or create your own from over 50 metrics.

Learn Now for Free

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not include recent company announcements that are not sensitive to pricing or quality equipment. Simply Wall St has no position in the stocks mentioned.

Have a comment about this article? Are you concerned about the news? Contact us directly. Alternatively, email editorial-team@simplywallst.com

#RichWave #Technology #Corporations #TWSE4968 #Stock #Returns #Taxes #Havent #Escaped #Investors #Attention