Many Capital One Financial Corporation (NYSE:COF) insiders have dumped their stock in the past year, which could be of interest to the company’s shareholders. Knowing whether insiders are buying often is very helpful when analyzing insider transactions, as insider trading can have different definitions. However, shareholders should take a closer look if many insiders are selling the stock over a period of time.

Although insider trading is not the most important thing when it comes to long-term investing, we would be foolish to ignore insider trading altogether.

Get a full review of the name Capital One Financial

Last 12 Months of Insider Transactions At Capital One Financial

Insider, Celia S. Karam, made the biggest insider sale in the last 12 months. That single trade was for shares worth US$2.4 million at a price of US$143 each. That means the insider was selling shares at the current price of US$136. Generally we don’t like to see insiders, but when the selling price is low, it affects us too more than. We note that this sale happened at the current price, so it is not a big problem, although it is not a good sign.

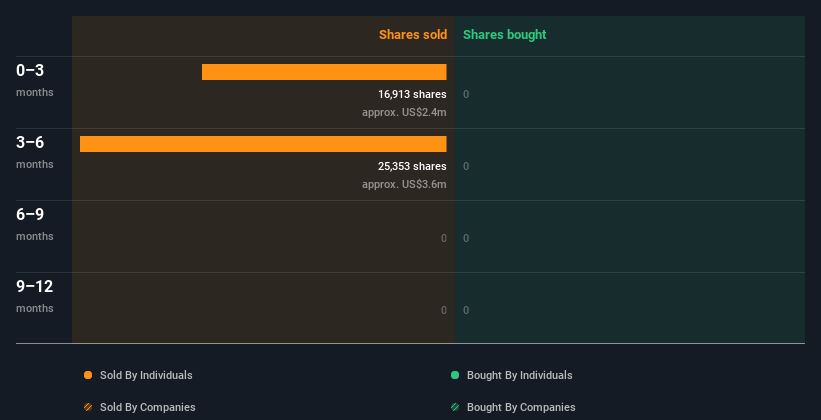

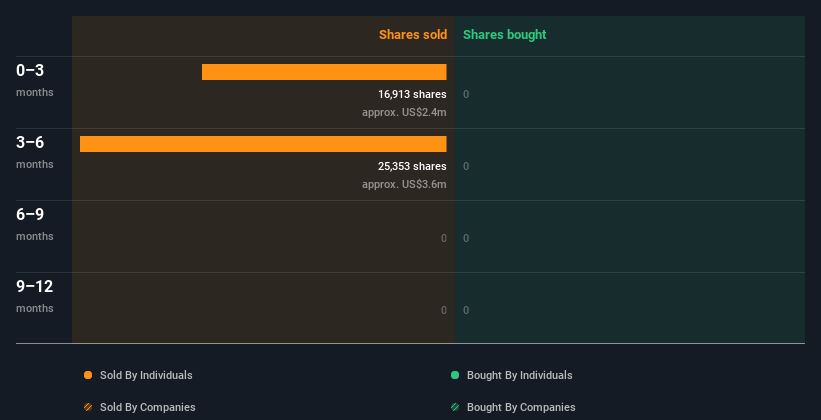

Residents of Capital One Financial have not bought any shares in the past year. The chart below shows internal transactions (by companies and individuals) over the past year. By clicking on the graph below, you can see the exact details of each internal transaction!

If you’re like me, you will not want to miss this for free a list of small stocks that are not only bought by insiders but also have attractive valuations.

Capital One Financial insiders sold the stock recently

In the last three months there have been key sales at Capital One Financial. In total, Celia S. Karam disposed of shares worth US$2.4m during that period, and we did not report any purchases. Generally this makes us cautious, but it is not the be all and end all.

Insider Ownership

Many investors like to evaluate how many people a company has. Insider ownership often makes the company’s leadership look after the interests of the shareholders. It is interesting to note that Capital One Financial investors own 1.2% of the company, which is worth about $627m. I like to see this level of insider ownership, because it increases the chances that the management will consider the best interests of the shareholders.

What Can Capital One Financial’s Internal Revenue Tell Us?

An insider sold shares of Capital One Financial recently, but did not buy them. And even if we look at the last year, we didn’t see a purchase. The company prides itself on having a lot of people, but we’re a little hesitant, given the history of share sales. So these internal transactions can help us create a thesis about the stock, but it is also important to know the risks facing this company. At Simply Wall St, find us 2 warning signs for Capital One Financial which deserves your attention before buying shares.

But be aware: Capital One Financial may not be the best stock to buy. So check this out for free list of interesting companies with high ROE and low debt.

For this article, insiders are people who report their transactions to the relevant regulatory body. We are currently responsible for open market transactions and private opinions of direct interests only, but not from other or indirect interests.

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not include recent company announcements that are not sensitive to pricing or quality equipment. Simply Wall St has no position in the stocks mentioned.

Have a comment about this article? Are you concerned about the news? Contact us directly. Alternatively, email editorial-team@simplywallst.com

#Bearish #Signals #Capital #Financial #Insiders #Dumping #Stock