The S&P 500 fell on Friday after a weak jobs report fueled concerns that the Federal Reserve’s decision to keep rates on hold for two decades could lead to a deeper recession. However, conventional wisdom expects the Fed to begin cutting rates in September.

In fact, Fed-funds futures now suggest a 71.5% chance of a rate cut twice (50 points) at the September Federal Open Market meeting. This marks a significant increase from a potential 22% prior to the release of the jobs report.

Lower interest rates promise lower interest rates and easier borrowing, both of which could benefit the biotech sector. Biotech companies, which operate at high costs, thrive in areas where credit is readily available.

Morgan Stanley equity analyst Mike Wilson elaborates on the value of biotech in a bearish environment: “While we’re discounting, we’ve recently discussed the fact that biotech is showing underperformance. The Fed begins to cut the policy rate. Our analysis of early rounds supports the fact that Biotech tends to outperform the market during periods of declining interest rates… especially around the Fed tapering period. ”

Wilson’s colleagues at Morgan Stanley analysts echo this view, and advise investors to buy two biotech stocks in particular. Both have high power – about 230% in one instance. According to TipRanks data banks, both stocks receive a ‘Strong Buy’ rating from the broad consensus of analysts, too; let’s take a closer look and find out why they are aimed at profit.

CervoMed (CRVO)

The first Morgan Stanley pick we’ll look at is CervoMed, a clinical stage firm specializing in neurodegenerative diseases and conditions. The company focuses on treating these conditions at their earliest stages, where interventions can be controlled and effective. CervoMed developed the main agent of the drug, neflamapimod, which leads to inflammation in the synapses – connections between nerve cells – causing damage. Neflamapimod is currently undergoing clinical trials as a potential treatment for dementia with Lewy bodies, an early-onset Alzheimer’s disease.

Neflamapimod inhibits the enzyme p38 alpha, which has been shown to be associated with the development of neurodegenerative diseases. Excessive or chronic activity of this enzyme disrupts the signaling process between neurons, causing synaptic dysfunction. This can lead to many different symptoms, including memory loss, cognitive impairment, and motor impairment, and eventually death of damaged nerves. Neflamapimod is a small molecule compound, designed to penetrate the brain, and is administered orally.

In June of this year, CervoMed announced the completion of enrollment for the Phase 2b trial, RewinD-LB, evaluating neflamapimod. The test aims to pave the way for a potential high-end market, with high-profile data expected to be released in December. Data from the first Phase 2a trial showed a positive effect of neflamapimod in patients with dementia with Lewy bodies.

The neflamapimod program is a key component of this biotech stock and supports Jeffrey Hung’s positive outlook on the shares. 5 star analyst Morgan Stanley writes, “The data presented so far support the results of Phase 2b which are expected in December 2024. Post-hoc analyzes from the Phase 2a study showed a significant improvement of ‘ ‘pure dementia’ and Lewy bodies for key areas of focus including dementia severity, functional mobility, and cognitive tests of attention and working memory.”

Looking ahead, Hung explains the risk-reward situation for investors ahead of the upcoming performance in December: “We believe that the next reading will be a big binary event but we have reason to believe that neflamapimod will be able to target the disease process. improvement across the key steps. We think that the risk/reward is skewed upwards with the probability that the shares trade > 100-150% in good data or drop to 65-75% (to below the amount) with disappointing results.”

Overall, the reviewer expects good clinical results and rates of CRVO and overweight (ie, Buy). His price target of $35 indicates a strong potential of ~230% in the next 12 months. (To watch Hung’s track record, click here)

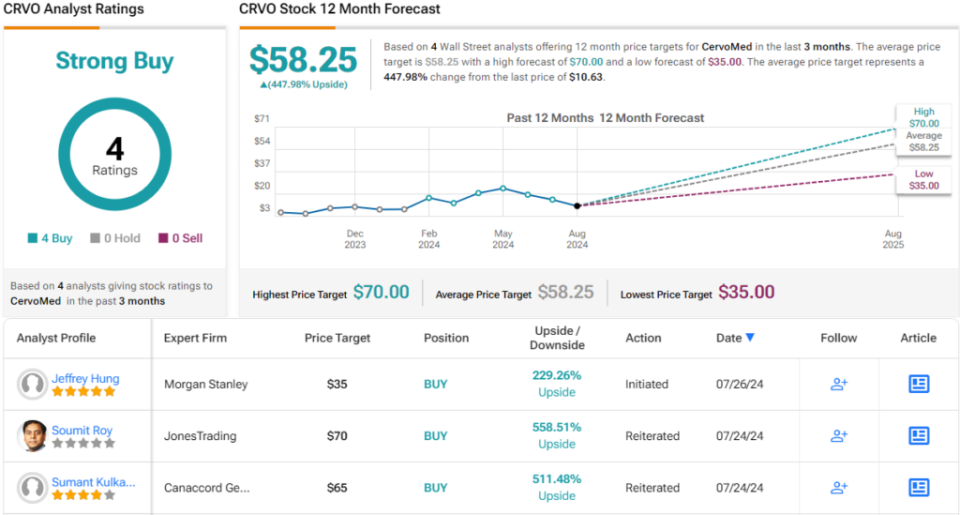

Overall, CervoMed has 4 recent reviews on record, with positive reviews – and gives the stock its consensus rating of Strong Buy. Shares are priced at $10.63, and their average price target of $58.25 suggests that CRVO could rise ~448% in the next year. (See Description of CRVO units)

Viking Therapeutics (VKTX)

Next under the Morgan Stanley microscope is Viking Therapeutics, a biopharmaceutical researcher dedicated to developing treatments for metabolic and endocrine disorders. The company is developing a pipeline of orally administered molecular vaccines that have the potential to become advanced or advanced drug therapies.

The pipeline consists of three candidates targeting obesity, non-alcoholic steatohepatitis (NASH), and X-linked adrenoleukodystrophy (X-ALD). These candidates are currently undergoing four clinical trials, including two with lead drug candidate VK2735 for the treatment of obesity.

VK2735 is being tested for both subcutaneous and oral dosing. A subcutaneous Phase 2 VENTURE trial showed significant weight loss, compared favorably with existing GLP-1 therapies. Based on these positive results, Viking is planning an end-of-Phase 2 meeting with the FDA and expects to disclose information about the upcoming Phase 3 trial thereafter. Similarly, a Phase 1 study of the oral formulation of VK2735 showed promising weight loss and improved tolerability, supporting dose escalation. Viking is set to begin a Phase 2 trial of oral VK2735 in the fourth quarter.

In addition to VK2735, Viking is optimistic about VK2809, its NASH candidate. In June, the company reported positive results from 52-week historical data from the Phase 2b VOYAGE study, showing significant improvement in NASH resolution, fibrosis, and better tolerability compared to Madrigal’s newly approved Rezdiffra. Viking intends to meet with the FDA in the fourth quarter to discuss the next steps for VK2809.

Finally, the company is working on VK0214, an orally available thyroid hormone receptor beta agonist, as a potential treatment for X-linked adrenoleukodystrophy (X-ALD). This rare neurodegenerative disease currently has no medical treatment. Viking has completed enrollment of participants in the Phase 1b study of VK0214 and expects to publish results by the end of the year.

‘Target shooting’ caught the attention of expert Michael Ulz. In his Viking report for Morgan Stanley, Ulz expresses optimism: “The company’s lead asset, VK2735 (SC/Oral), has shown promising early results, showing ang potential high level in the obesity and growing market.Although obesity is still the focus, we believe that the recent data of VK2809 suggest the potential of NASH, which represents another, potential market opportunity. Overall, we believe the early data puts both programs at risk and we expect more catalysts in 2H24 to raise the bar.”

These comments support Ulz’s Overweight (i.e., Buy) rating on VKTX, and he complements that with a $105 price target that indicates his confidence at 98% 12-month upside. (Watching the track record of Ulz, click here)

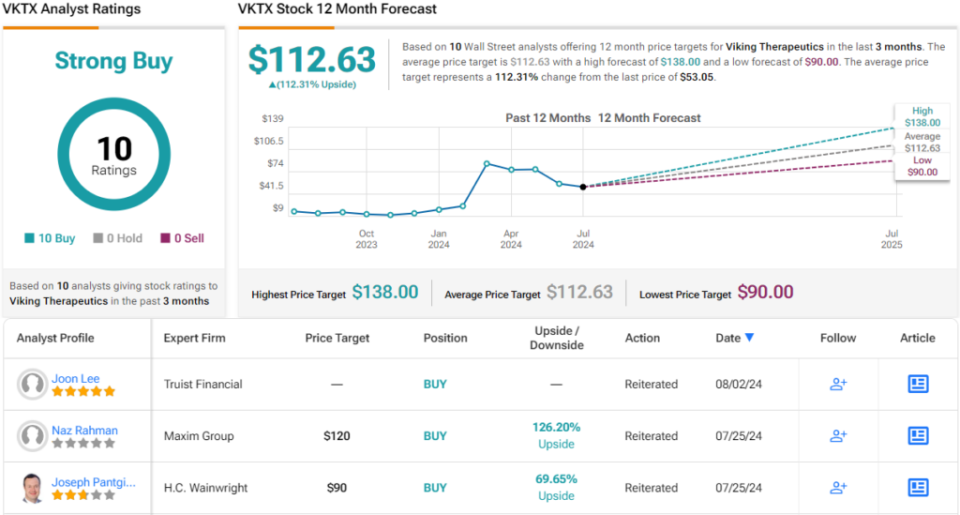

In total, there are 10 positive reviews reported for VKTX, which support a Strong Buy consensus rating. Shares are currently trading at $53.05 and the stock has 112% upside for the next year, based on the price target of $112.63. (See Description of VKTX features)

To find the best ideas for trading stocks with attractive valuations, visit TipRanks’ The Best Stocks to Buy, a tool that aggregates all of TipRanks’ equity data.

Disclaimer: The opinions expressed in this article are those of the featured reviewers only. Content is intended for informational use only. It is very important to do your own due diligence before making any investment.

#Morgan #Stanley #Predicts #upside #Strong #Buy #stocks