Tidal Investments LLC lowered its stake in shares of Spotify Technology SA (NYSE:SPOT – Report Free) by 22.9% in the first quarter, according to its most recent 13F filing with the SEC. The firm owned 4,998 shares of the company’s stock after selling 1,483 shares during the period. Tidal Investments LLC’s holdings in Spotify Technology were worth $1,319,000 at the end of the most recent reporting period.

Tidal Investments LLC lowered its stake in shares of Spotify Technology SA (NYSE:SPOT – Report Free) by 22.9% in the first quarter, according to its most recent 13F filing with the SEC. The firm owned 4,998 shares of the company’s stock after selling 1,483 shares during the period. Tidal Investments LLC’s holdings in Spotify Technology were worth $1,319,000 at the end of the most recent reporting period.

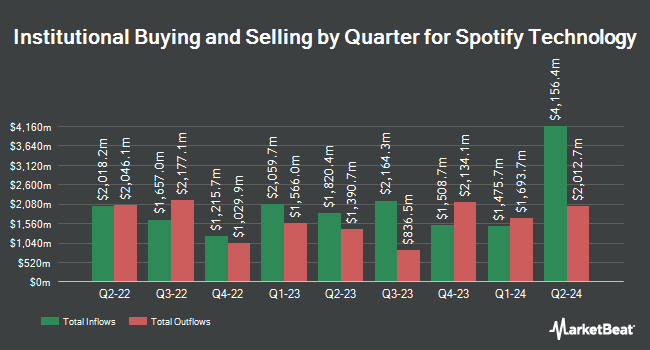

A number of other hedge funds have also recently made changes to their positions in the company. Vanguard Group Inc. grew its position in Spotify Technology by 2.0% in the 3rd quarter. Now Vanguard Group Inc. now owns 554,066 shares of the company’s stock valued at $85,681,000 after acquiring an additional 10,703 shares in the last quarter. Raymond James & Associates grew its holdings in shares of Spotify Technology by 19.0% in the fourth quarter. Raymond James & Associates now owns 38,410 shares of the company’s stock valued at $7,218,000 after buying an additional 6,139 shares in the last quarter. Raymond James Financial Services Advisors Inc. increased its stake in Spotify Technology by 10.3% during the 4th quarter. Raymond James Financial Services Advisors Inc. now owns 24,266 shares of the company’s stock worth $4,560,000 after purchasing an additional 2,263 shares during the period. Private Trust Co. NA increased its stake in Spotify Technology by 18.4% during the 4th quarter. Private Trust Co. NA now owns 367 shares of the company’s stock worth $69,000 after buying an additional 57 shares during the period. Finally, International Assets Investment Management LLC acquired a new stake in Spotify Technology during the 4th quarter worth approximately $32,944,000. Hedge funds and other institutional investors own 84.09% of the company’s stock.

Wall Street Analysts Forecast Growth

Several research firms have commented on SPOT. Wolfe Research began coverage on shares of Spotify Technology in a research note on Friday, July 12th. They issued an “outperform” rating and a $390.00 price objective for the company. JPMorgan Chase & Co. boosted their target price on Spotify Technology from $375.00 to $425.00 and gave the stock an “overweight” rating in a research note on Wednesday, July 24th. Guggenheim upped their price target on Spotify Technology from $400.00 to $420.00 and gave the stock a “buy” rating in a report on Wednesday, July 24th. Macquarie lifted their price objective on Spotify Technology from $345.00 to $395.00 and gave the company an “outperform” rating in a research report on Tuesday, July 23rd. Finally, Bank of America lifted their target price on shares of Spotify Technology from $370.00 to $380.00 and gave the stock a “buy” rating in a research report on Tuesday, July 2nd. One research analyst has rated the stock with a sell rating, five have issued a hold rating and twenty-two have given a buy rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of “Moderate Buy” and a consensus target price of $353.15.

Check out our latest stock analysis on SPOT

Spotify Technology Stock Performance

Shares of SPOT opened at $330.85 on Friday. The company’s 50-day simple moving average is $313.77 and its 200-day moving average is $282.08. The firm has a market cap of $65.86 billion, a PE ratio of -493.80 and a beta of 1.59. Spotify Technology SA has a 12-month low of $129.23 and a 12-month high of $359.38. The company has a current ratio of 1.56, a quick ratio of 1.56 and a debt-to-equity ratio of 0.31.

Spotify Technology (NYSE: SPOT – Get the Free Report ) last released its quarterly earnings results on Tuesday, July 23rd. The company reported $1.33 earnings per share (EPS) for the quarter, topping analysts’ consensus estimates of $1.08 by $0.25. Spotify Technology had a return on equity of 15.23% and a net margin of 3.22%. The firm had revenue of $3.81 billion for the quarter, compared to analyst estimates of $3.82 billion. In the same quarter last year, the company posted ($1.69) earnings per share. Business income was up 19.8% year-on-year. As a group, financial analysts predict that Spotify Technology SA will post 6.32 EPS for the current year.

Spotify Technology Profile

(Free Report)

Spotify Technology SA, together with its subsidiaries, provides audio subscription services worldwide. It works in two versions, Premium and Ad-Supported. The Premium feature provides unlimited internet and broadband access to music catalogs and podcasts without commercial breaks to subscribers.

Stories From

Get Spotify Technology News and Information Daily – Enter your email address below to receive a concise daily summary of the latest news and analyst information for Spotify Technology and related companies with our FREE daily newsletter of MarketBeat.com.

#Tidal #Investments #LLC #Trims #Holdings #Spotify #Technology #NYSESPOT