Luis Alvarez/DigitalVision via Getty Images

Introduction

GigaCloud Technology (NASDAQ: GCT) has had an incredible run since the bottom of March last year, so I wanted to take a closer look at the company’s financials to see if it will do so. be a good time to start the situation. The company’s top-line growth has been phenomenal, while margins have been increasing. The question is whether that high-level growth is sustainable, but if we take conservative estimates, the company’s growth may slow down a bit so that it remains an attractive investment, so I’m starting a buy position , and I opened the smaller ones. situation.

Briefly about the Company

GCT is a global platform for end-to-end B2B e-commerce solutions. The company helps connect manufacturers of big-ticket items such as furniture and sports equipment, mainly in Asia, with wholesalers of such items. America, Asia and Europe. In the end, the company actually does all the work related to getting the goods from A to B. For example, the company has a list of the manufacturer’s products that need to be shipped to the customer. , usually an online business, that cares. of all materials. It is basically a logistics business, with many fulfillment centers that help manufacturers store their goods for e-commerce businesses, and then from these businesses, consumers are delivered their goods.

Finances

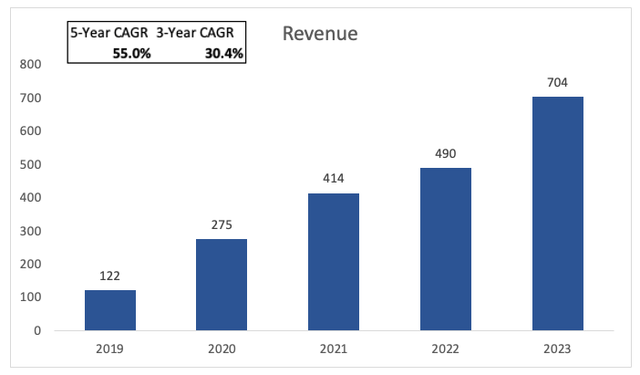

Let’s start from the top. The growth rate of GCT has been quite impressive I would say. The company went from $122m in FY19 to $704m by the end of 2023. That’s a whopping CAGR of 55% since it first went public. However, in the last 3 years, growth has slowed slightly to 30%. Still, it’s very interesting.

Secretary

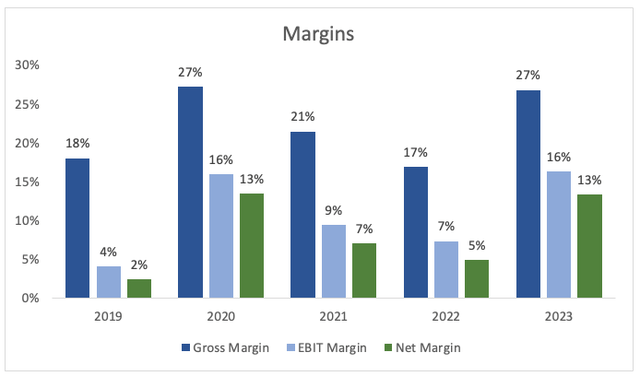

Looking at the company’s margins, we see a significant improvement from FY22 to FY23. It seems that such an improvement in estimates across the board can be attributed to the acquisition of the company Noble House, and the general improvement of the economy, for example, lower costs of goods due to lower prices and to first it seems to maintain such a limit. profile, the company has avoided fuel price volatility, according to the article, which is a wise decision.

Secretary

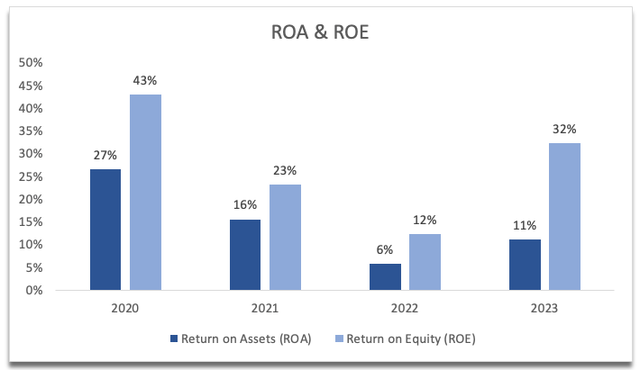

As we move forward with profitability, we can see a similar trend occurring in return on assets and equity, ROA and ROE. FY22 appeared to be the bottom line, and since then the company has seen its bottom line improve significantly, helping ROA and ROE to almost double. Managers seem to know very well how to use the company’s assets and shareholders’ money, thus creating value.

Secretary

The next metric I like to look at is a company’s return on equity, which measures a company’s profitability compared to its total assets. It basically tells us how the company uses its available capital, which is debt and equity, to make a profit. I use this metric to tell me if a company has a competitive advantage and moat, and often, I can compare it to its peers, but the company doesn’t outrank their peers in their 10K, and I don’t think it can. Be biased to compare it to the likes of Amazon, Wayfair or Ikea, especially since the business model is not the same and the peers selected by Batla Alpha don’t look right either. Therefore, I will only look at company ROTC. I would like to see the company at least achieve 10% ROTC considering it is a strong investment. The latest ROTC ratio of GTC stands at 14%, according to SA, which is much higher than the minimum, and tells me that the company uses its assets very efficiently and can ‘ have strong purchasing power, and proper control of operating costs.

According to the company’s financial statement, as of Q1 ’24, which was filed on May 9th, GCT had $195m in cash and ST funds, against book debt. That’s a good position to be in, and as I always say it should help attract investors who don’t like to spend money. The only interest expense the company has is the rent for the US executive facilities, which is easily covered by the company’s interest rate on cash.

Overall, the company has been doing well since it went public. Revenues have been increasing over the years, but if we look beyond the top line, we can see two years of poor performance during FY21 and FY22, when both operations and profits improved . However, the company seems to have recovered in FY23 and is poised to continue to perform well in the coming quarters as evidenced by the improvement in Q1 ’24 in total units y/y.

Comments on Outlook

I think the biggest uncertainty in the company’s outlook is the uncertainty of the US economy. Inflation remains very stable, while interest rates remain high. America’s economy has developed a lot and it was not what the FED wanted when it started raising interest rates to fight inflation. However, it seems that everything is starting to go the way the FED wanted, which is to control inflation, and if it means a rise in unemployment , so be it. The latest non-farm payrolls report made markets cooler than expected (114k added vs 180k expected), while the unemployment rate edged up. started to rise slowly, and now it stands at 4.3% vs 4.1% a month before.

This seems to me that the FED is ready to cut interest rates, and there is a high probability that the first one will come in September. Markets think it may be too late and the US will see another form of recession with the unemployment rate likely to continue to rise. So, what does that mean for GCT? In short, fewer people are employed, tighter budgets, which means no big-ticket items like furniture and sports equipment.

On the other hand, if we will see a reduction in interest rates starting in September, this should help with sales, and boost consumer confidence. House prices may increase due to low interest rates, which means there will be more demand for furniture. That’s as long as the unemployment rate doesn’t get out of hand again.

The company’s warehouse business model is very attractive and flexible, customers can browse GCT warehouses and choose which items to sell through Amazon, Rakuten, Walmart, Wayfair and Home Depot, or even in their store. So, the company’s products can be sold in different ways, the question is how the general economic outlook will affect its top-level growth, which is very impressive so far. Can it maintain 30%-50% of top-line growth going forward? What will its margins look like if we enter a recession in the next year or so? Let’s look at an example of a false positive.

Value for money

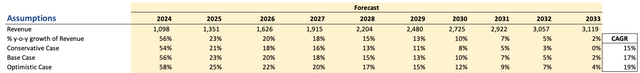

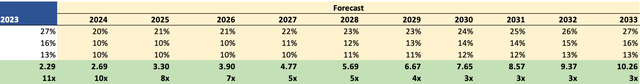

As usual, I will be approaching the value model with a fixed mindset. The company is not well covered on the Street; however, I will be taking the next year of growth at face value. 56% is a given, given how well the company did in Q1, and the upcoming Q2 looks to be the same, so around $1.1B in sales is a reasonable assumption. After that, it is difficult to estimate, but it is better to be at the end of the best trends, so I decided to lower the growth rate to 23% and go down to 2% in FY33, to give me 17% CAGR over the next ten years. This is significantly lower than what the company has realized in the past 5 years, which only helps my ethical thinking in the end.

Secretary

In terms of margins, I decided to apply net reduction to 20% and net operating margin to 10% for FY24, which is a reduction of 700bps and 600bps, respectively. In the next ten years, I think the company will return to the same channels that it saw at the end of FY23, so I think this is a very conservative result for the company.

Secretary

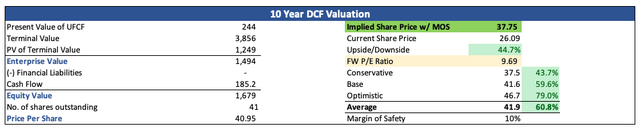

I also use a higher discount rate of 12% to give myself more margin for error in the above estimates, and a growth rate of 2.5% because I like the company to at least match the US long-term inflation target . Additionally, I’m going to lower the final value by 10% to give myself more room for error in the estimates. That being said, GCT’s underlying value is about $38 per share, which means it is trading below its fair value.

Secretary

Comments Close

As I summarized in the overview, the biggest risk is the instability of the US economy. If you believe that the company will not see a significant decline in its sales in the coming years, the company is a buy at this level. Also, the above valuation which is at the end of the trend, gives me hope that even if the company’s profit is falling, it is still a good buy in these conditions. I think 17% CAGR is too low for a company that has grown at a very fast pace; however, it would be interesting to hear what the company has to say in the next few episodes. However, I opened a small position during this downturn in the broader market and will see if I want to add in the future, especially when the company reports Q2 next week.

It appears that the company is still trading at a low price, even though it has finished off the March ’23 low. If I see a reasonable decrease in future areas, I will adjust my model accordingly and decide what I want to do next.

#GigaCloud #Technology #Sales #Internet #Reviews #Good #Performance