CFOs take a stronger role in IT decisions in Australia and New Zealand by 2024.

Research from the company Rimini Street shows that CFOs are often the ones who guide the basic technology decisions – a responsibility that is traditionally held by CIO’s.

The survey, C-Suite Needs: Evolving IT and Enterprise Investments, surveyed 250 CFOs and CIOs in the ANZ region. It revealed that closer collaboration improves CFO and CIO relationships, which can result in higher IT budgets and business return on investment.

Up to 70% of technology decisions involve CFOs by 2024

CIOs used to have primary responsibility for technology decisions made by businesses. However, Rimini Street’s research found 60% of CFOs say they are responsible for basic technology decisions to achieve business results, marking a shift in how decisions are made.

IT research firm ADAPT Research has also noticed this trend. ADAPT’s director of research, Matt Boon, estimated at a recent conference in Sydney that CFOs are now part of 70% of all IT financial decisions. He said this level is “the highest we have ever seen.”

CFOs are not the only ones noticing this change. CIOs agree that their CFO counterparts make the basic technology decisions and take a leading role in setting the technology budget.

Why are CFOs so involved in technology decisions?

The increased focus on Australian and New Zealand funds is no secret. The market has seen inflation, high interest rates and slow business growth. IT leaders in this area have been under pressure to do more with the same or less or face less budget increases.

Toolkit: How CFOs have evolved from underdogs to key drivers

The environment has brought CFOs closer to technology oversight and decision-making. CFOs are concerned about costs, as factors such as rising cloud costs hit the bottom line. They are also interested in the contribution of technology investments to grow the business.

CFOs lament the lack of connection to business goals

A Rimini Street report showed that only 23% of CFOs are happy with the impact that technology investments are making on their business goals – the main reason why they are more involved in technology decisions. That leaves nearly 3 in 4 CFOs who aren’t fully satisfied with the results of their technology investments or who don’t think IT investments are aligned with business goals.

In fact, many CFOs are skeptical when asked about organizational technology. Among the CFOs surveyed:

- 29% have seen only mixed results from technology investments, when measured against achieving a desired business outcome or achieving adequate long-term value.

- 19% say they often see a negative impact from technology investments, including ongoing costs, poor future prospects or business disruption.

- 17% surveyed by Censuswide for Rimini Street say that most of the organization’s technology investments are not related to their business plans.

- 12% saw little or no improvement from their technology investment, and/or the cost of the investment outweighed the value of the improvement.

Strong CFO and CIO relationships benefit businesses

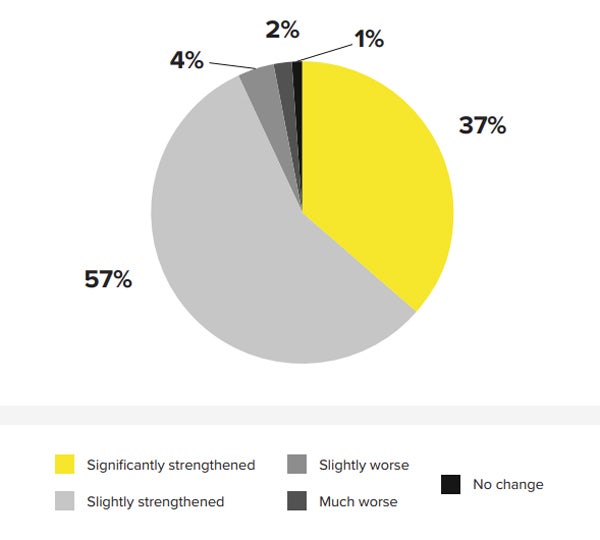

Despite some CFO dissatisfaction, 94% of respondents said the relationship between the CFO and CIO has improved a lot or a little. This is a big part given that the CFO continues to overlap with some of the traditional duties of the CIO.

CFOs see CIOs in the right light

Close collaboration gives CFOs a better impression of CIOs. The study found:

- 39% of CFOs considered their CIO a “change agent who drives business strategy.”

- 33% see their CIOs as partners who help connect the dots between technology and business decisions.

Rimini Street says these skill sets go beyond the basic technical abilities of many IT workers.

“It speaks to leadership and collaboration more than technical skills, indicating that at least on the CIO side, they are learning the language of the CFO,” according to the report.

Why the CFO-CIO bond is growing stronger

The volatile business environment has been a reason to strengthen the relationship between CFOs and CIOs, as they are required to work closely together. According to the Rimini report, some of the reasons chosen by CIOs and CFOs for a strong bond are:

- Another leader is active (39%).

- Focus on security, compliance and risk (38%).

- Urgent need for collaboration in scientific decision-making (37%).

- The need to accelerate IT spending in a smart way (35%).

Rimini Street says CFOs are increasingly dependent on CIOs because of the complexity of IT decisions and seek CIO guidance with technology-based priorities, such as security and technology. appearing. CIOs look to CFOs to help them with budgeting and senior advocacy.

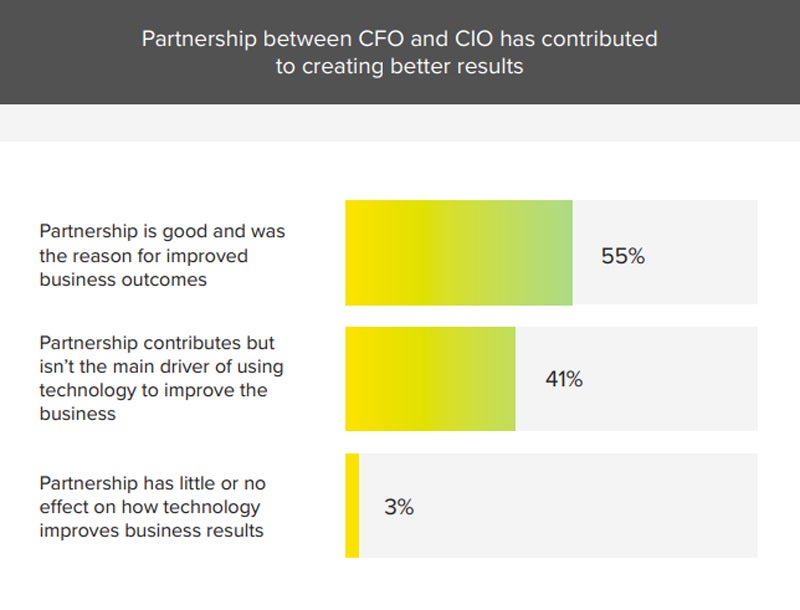

CFOs believe that a close collaboration with the CIO is good for the business

More than half of CFOs in the ANZ region (55%) believe that a good CFO-CIO relationship has contributed to better business results. A whopping 41% think collaboration contributes to, even if it’s not the primary driver of, improving business results.

CFO and CIO business relationships still have room for improvement

The relationship between the CFO and the CIO can still be improved. For example, CFOs and CIOs both think that the other should better understand their discipline:

- A large proportion of CFOs (91%) indicated that their CIO counterpart needs to know more about the business to communicate better with them.

- A total of 96% of CIO respondents indicated their CFO counterpart needs to have technical skills to improve communication with them.

Why CFO and CIO relationships are deteriorating

A smaller proportion (6%) of CFOs report having a poor relationship with their CIO. Among these CFOs, 38% attributed this issue to a lack of expertise in dealing with security, compliance and risk issues, while another 38% stated that the CIO’s lack of flexibility in identifying ways to reduce IT costs.

Other reasons for CFO dissatisfaction included CIOs showing a disappointing lack of urgency (23%), developing plans that don’t show an adequate return on investment (23%), or not accepting additional commitments (23%). These issues show that both skills and work styles can be relationship factors.

How IT leaders can better collaborate with their CFOs

Savvy IT leaders have the opportunity to strengthen CFO relationships that continue to advance the interests of IT within the organization – especially when it comes to finance and investment.

Practice working closely with CFOs

IT costs are increasing as a percentage of total revenue, with 79% of respondents to the Rimini Street report saying they are increasing. As IT balloons in importance, both in terms of cost and as a driver of business value, CIOs should expect more input and scrutiny from CFOs.

WATCH: Four proven ways to maximize your value as a CIO in 2024

Rimini Street added that CFO dissatisfaction with technology investments could lead to further inflows.

“This [CFO dissatisfaction] is a clear indication that CIOs expect a higher level of collaboration with their business partners, as well as preparing for increased oversight to ensure that their technology choices drive business value,” the report said. .

Learn how CFOs evaluate technology decisions

CIOs can benefit from better understanding how CFOs evaluate the value of new technology investments. As expected, Rimini Street found that CFOs are more focused on the financial impact of investments. The top five takeaways from CFOs in technology investments are:

- Value of business strategy.

- The sustainability of the technology solution.

- A return on investment is expected.

- Ease of maintenance and support.

- CAPEX and OPEX data.

What CFOs want CIOs to focus on

CFOs may have different opinions about what CIOs should focus on. For example, research found CFOs want CIO priorities to include risk management and compliance, customer success and engagement, major ERP upgrades and migrations, and revenue-generating technology.

CIOs may have a different perspective than their CFO when discussing technology-related decisions — especially in terms of the importance of risk management and compliance for the CFO. But Rimini Street says CIOs can be confident that, in general, CFOs are more driven by results and return on investment than they are by the technology itself.

Move easily to ‘shiny players’ and emerging technologies

CIOs are very interested in emerging technologies: 64% of surveyed CIOs are already investing in artificial intelligence, while an additional 28% plan to invest this year. However, they understand the need to be cautious, with 34% saying they only supplement existing business technology rather than investing in new technologies.

SEE: 3 best practices for CIOs using emerging technology for business results

This awareness can support the CFO-CIO relationship even more. Rimini Street found that CFOs are not necessarily opposed to the introduction of emerging technologies, but have indicated that they want to ensure that they get the most value from new technologies.

Dedicated CFOs support CIOs with future IT projections

CIOs will benefit from increased collaboration with CFOs. The report found that, if the CIO were to approach the CFO with a reasonable proposal for IT funding that could demonstrate ROI, 23% of the CFO would be willing to approach the board to obtain the necessary funding.

This bodes well for future CIOs. With the need to stay on top of things and invest in new technologies like AI to keep businesses competitive, support from CFOs and a strong foundation of relationships can be key to business success. of the future.

#CFOs #Involved #Technology #Decisions #Australia #Zealand